For a long time, I did exactly what the system asked of me.

I zealously advocated for my client in an adversarial system. I prepared for battle, protected positions, and worked hard to secure outcomes that looked successful on paper. I participated in marathon mediations where the goal was endurance—stay at the table long enough and an agreement would eventually emerge.

And often, it did.

But over time, I began to notice something that unsettled me.

When “Success” did not feel Like Success

Many clients left those marathon mediation days exhausted rather than relieved. Agreements were reached, but they often felt forced—products of pressure, fatigue, and fear rather than clarity or understanding.

I watched clients nod along, eager for it to be over, only to return later with new disputes. The conflict had not resolved; it had simply changed form. What was framed as finality was, in reality, a pause.

The process was efficient. It was also deeply human in its cost.

The Limits of the Adversarial Model

The adversarial system is designed to create winners and losers. Zealous advocacy has its place, particularly when safety or power imbalances are present. But I began to see how often this framework amplified defensiveness rather than resolved it.

People were encouraged to harden their positions, simplify complex emotions into legal arguments, and move quickly toward outcomes that did not reflect the full reality of their lives—especially when ongoing relationships, like co-parenting, were involved.

The approach was, in many ways, cookie-cutter. The same tools were applied regardless of the people, the dynamics, or the long-term consequences.

The Moment of Reckoning

What finally shifted my perspective was not a single dramatic case, but a growing pattern. I could no longer ignore the disconnect between what the system valued and what my clients actually needed.

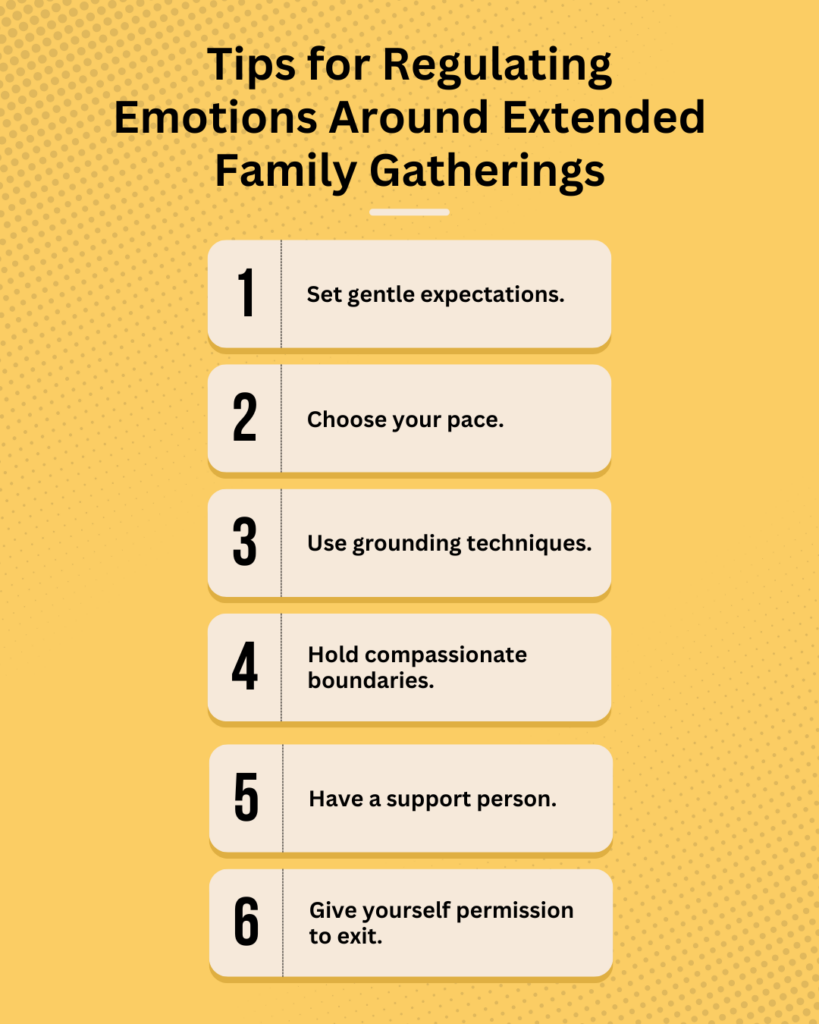

They needed:

- To feel heard, not managed

- To understand their choices, not just accept them

- To leave the process with confidence, not lingering doubt

I realized that I was helping people end legal disputes without helping them understand the conflict itself.

That realization changed how I thought about my role.

Choosing a Different Way

I began moving toward a transformative, insight-based approach because it allowed for something the transactional system did not: space.

Space to slow down. Space to explore what was underneath the positions. Space to recognize fear, grief, and misunderstanding as information rather than obstacles.

Instead of pushing for agreement at all costs, I became more interested in what helped people shift internally. What reduced defensiveness. What restored a sense of agency.

The difference was immediate—and profound.

How my Work feels different now

Today, my work as an attorney representing clients or as a neutral mediator is less about forcing resolution and more about creating clarity. I no longer measure success by how quickly an agreement is reached, but by how grounded people feel in the decisions they make.

I pay close attention to moments of resistance or reactivity, because those moments often signal where understanding is missing. Rather than rushing past them, we explore them.

Agreements reached this way tend to last—not because they are perfect, but because they are owned.

What gives me Hope

What gives me hope is watching clients leave mediation with energy rather than exhaustion. With language for difficult conversations. With confidence that they can navigate future conflict without returning to crisis mode.

They tell me they recover more quickly when disagreements arise. That co-parenting feels less charged. That they trust themselves more.

That is the work I was searching for.

Looking Back. AND Forward

I do not see my earlier work as a failure. It was necessary to understand its limits. What I see now is evolution—a willingness to question a system that valued speed over substance and to choose a path that honors the human experience of conflict.

Becoming a transformative mediator has allowed my work to align with my values and my lived experience. It has given me a way to serve clients not just in ending disputes, but in building capacity for what comes next.

And that, for me, has made all the difference.